Related articles

BeCexy (CEXY) Airdrop & Price Prediction: How High Will CEXY Go Post Listing?2025-12-11 17:30:04BeCexy is a crypto-based gaming platform connected to t […]

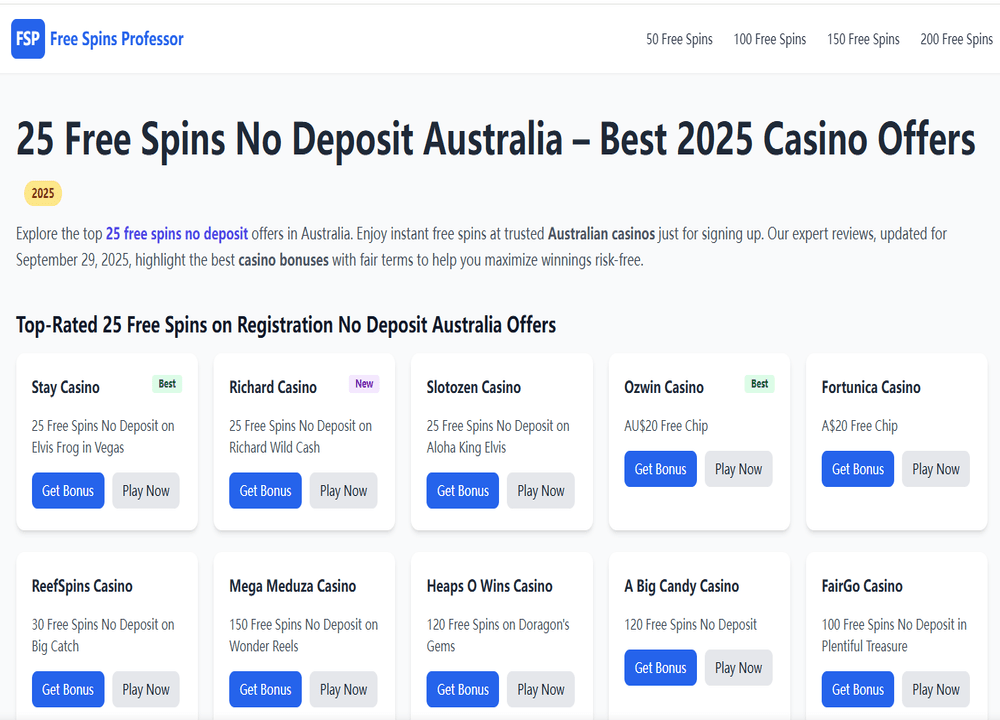

Online Casino Mumblescafe.com Review 2025: Best Free Spins No Deposit Bonuses In Australia?2025-12-11 10:00:52In the competitive world of online gambling, players ar […]

What Is United States Crypto Reserve (USCR): Everything You Need To Know About It2025-12-10 09:30:49As global interest in digital assets continues to grow, […]

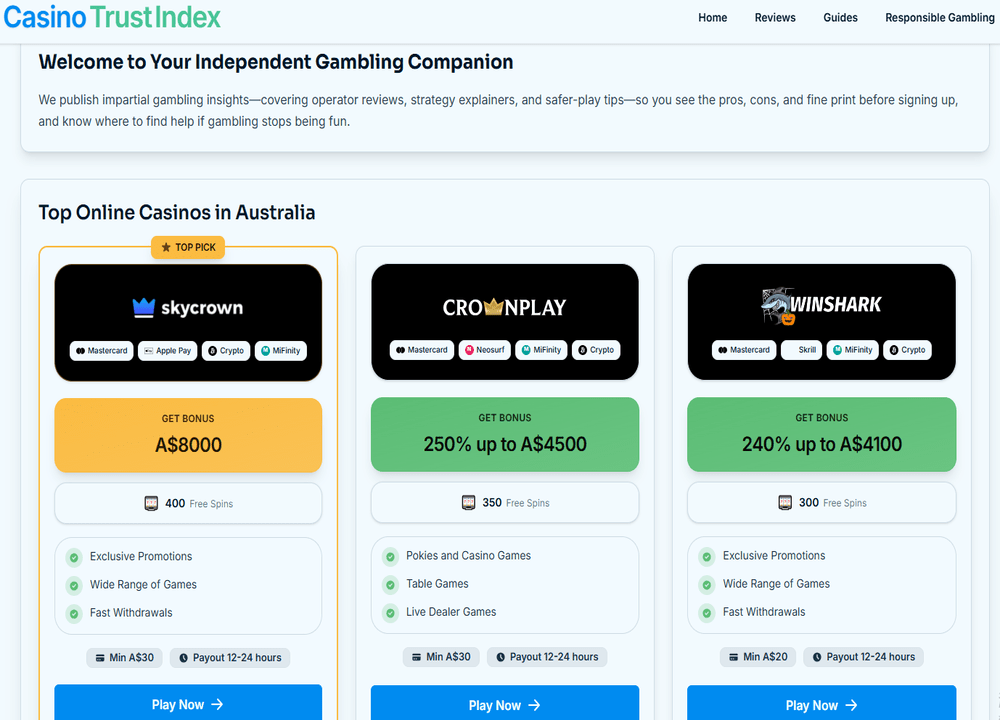

Casinotrustindex.com Online Casino Australia Review 2025: Trusted Online Gambling Guides & Expert Insights2025-12-10 09:00:34The rapid growth of online gambling in Australia has re […]